Teach your children about money by reading and doing activities with them, such as finding stories about earning and saving, playing games while shopping, and comparing prices. This will help them understand the importance of saving money and setting financial goals.

Teaching kids about money matters is an essential life skill that can set them up for a successful financial future. By instilling good financial habits at a young age, children can learn the value of money, the importance of saving, and how to make wise financial decisions.

Reading stories about earning, saving, and financial goals, as well as engaging in interactive activities like shopping games, can make the learning process fun and engaging for kids. We will explore the benefits of teaching kids about money matters and provide practical tips on how parents can educate their children about financial responsibility.

Table of Contents

ToggleFoundations Of Financial Education

Teaching kids about money and financial responsibility is an essential skill that will benefit them throughout their lives. By providing them with a strong foundation in financial education, we can equip them with the knowledge and skills they need to make wise financial decisions in the future. In this blog post, we will explore three key areas of financial education for kids: differentiating between needs and wants, budgeting basics, and teaching kids about saving and borrowing.

Differentiating Between Needs And Wants

One of the first lessons in financial education for kids is understanding the difference between needs and wants. Needs are essential items that we require for survival, such as food, shelter, and clothing. Wants, on the other hand, are things that we desire but do not necessarily need. Teaching kids to differentiate between needs and wants can help them develop a sense of priorities and make better spending choices. Here are a few strategies to teach this important concept:

- Discuss real-life examples of needs and wants with your child.

- Engage in role-playing scenarios where they have to identify needs and wants.

- Encourage them to think critically about their own wants and prioritize their spending.

Budgeting Basics For Kids

Another crucial aspect of financial education for kids is learning the basics of budgeting. Budgeting allows children to understand the value of money and how to allocate it wisely. Here are some simple steps to introduce budgeting to kids:

- Help them set financial goals, such as saving for a toy or a special outing.

- Show them how to track their income and expenses using a simple budgeting worksheet.

- Teach them about the importance of saving a portion of their income for future goals.

- Encourage them to prioritize their spending and make smart choices when it comes to buying items.

Teaching Kids About Saving And Borrowing

Teaching kids about saving and borrowing is essential in financial education. It helps children understand the importance of saving money for future needs and goals, as well as the potential risks and benefits of borrowing. Here are a few strategies to teach kids about saving and borrowing:

- Introduce them to the concept of saving money in a piggy bank or a savings account.

- Show them how saving regularly can help them achieve their financial goals.

- Discuss the difference between borrowing money and saving up for a purchase.

- Highlight the importance of repaying borrowed money and the potential consequences of not doing so.

Credit: www.cnbc.com

Building Financial Skills

Build financial skills in kids with Money Matters Lessons. Teach them about earning, saving, and setting financial goals through interactive activities like reading stories, playing games, and comparing prices when shopping. Practical Money Skills offers fun and educational resources to help children learn financial responsibility.

Teaching kids about money management is crucial in preparing them for financial independence. Building strong financial skills early on can help set a solid foundation for their future. It’s never too early to start teaching children about financial literacy. From understanding the basics of savings and checking accounts to learning about credit and debit, there are numerous ways to make it engaging and interactive for kids.

Understanding Savings And Checking Accounts

Understanding the concept of savings and checking accounts is an essential part of financial education for kids. Here’s a quick breakdown:

- Savings Account: This account helps children learn the importance of setting money aside for future needs or goals. It also introduces the concept of earning interest on savings.

- Checking Account: Children can grasp the idea of making payments, depositing money, and tracking transactions through a checking account. It allows them to understand the practical aspects of managing money.

Credit Vs. Debit: Explained For Kids

Explaining the difference between credit and debit in simple terms can help kids understand how money works. Here’s a simplified explanation:

- Credit Card: A credit card allows you to borrow money up to a certain limit. It’s important to emphasize responsible usage and timely repayments to avoid debt.

- Debit Card: With a debit card, you can only spend the money available in your checking account. It’s a good way to introduce the concept of using funds that are readily available.

Fun Ways To Teach Financial Literacy Through Interactive Games

Engaging kids in interactive games can make learning about financial literacy enjoyable. Here are some fun activities to consider:

- Money Management Board Games: Board games like Monopoly or The Game of Life can teach children about managing money, making investments, and handling unexpected expenses.

- Online Financial Simulations: There are interactive online games that simulate real-life financial scenarios, providing a hands-on experience in managing finances.

- Role-Playing Activities: Encourage kids to take on different roles, such as being a shop owner or customer, to learn about budgeting, spending, and saving money.

By incorporating these strategies, parents and educators can effectively instill valuable financial skills in children, setting them up for a successful financial future.

Practical Applications

Teaching kids about money is crucial. Engage them in hands-on activities like budgeting and saving to instill financial responsibility. Incorporate real-life scenarios for practical money lessons.

Real-life Scenarios To Teach Financial Responsibility

Teaching kids financial responsibility through real-life scenarios can greatly impact their understanding of money matters. Take them along for grocery shopping and involve them in decision-making. For instance, discuss the importance of comparing prices, understanding the value of money, and making budget-conscious choices.

Incorporating Money Lessons In Everyday Activities

- Utilizing everyday activities, such as setting up a lemonade stand or a garage sale, can teach kids the concept of earning and managing money. Activities like these provide practical learning experiences that are memorable and impactful.

Teaching Kids To Compare Prices And Make Informed Choices

- In today’s consumer-driven society, teaching kids to compare prices and make informed choices is crucial. It is important to show them the value of making smart purchase decisions and how it can affect their financial well-being.

Engaging Resources

Explore engaging resources like practical money skills games and educational opportunities to teach kids essential money matters. Play interactive games, read stories, and make learning about earning, saving, and budgeting fun and interactive for children. Incorporate real-life scenarios to instill valuable financial lessons from an early age.

Money Matters For Kids: Book Recommendations

Introducing children to financial literacy through books can be both educational and enjoyable. Below, you’ll find some engaging resources to help kids gain a better understanding of money management and financial responsibility:

- Moose Tracks! by Karma Wilson and Jack E. Davis: A story about saving and spending in a relatable and enjoyable way.

- The Berenstain Bears’ Trouble with Money by Stan and Jan Berenstain: Teaches kids about earning money and making spending decisions.

- A Smart Girl’s Guide: Money by Nancy Holyoke: Offers practical advice for girls on managing money.

Online Platforms For Financial Learning

The internet offers a wealth of resources to teach children about financial literacy. Here are some quality online platforms designed specifically for kids:

- KidsMathTV: Offers a series of engaging videos covering topics like budgeting, savings habits, and real-life financial scenarios.

- Learn Bright: Provides educational videos on needs versus wants, budgeting, and distinguishing between credit and debit.

- Practical Money Skills for Life: This site offers interactive games to help teach children various financial skills.

Podcasts And Videos For Children’s Financial Education

Podcasts and videos can be entertaining and educational tools for teaching financial literacy to kids. Here are some recommended resources:

- “Teaching Kids Money Matters with Scott Donnell” on Amberly Lago’s YouTube channel: Distinguishes between inheritance and heritage funds and provides insights on GravyStack as a method for imparting money skills to children.

- “Financial Literacy for Kids” on Learn Bright’s YouTube channel: Covers various financial topics like needs versus wants, credit versus debit, and making a budget.

Key Concepts In Financial Literacy

Financial literacy is imperative in today’s world, and instilling key concepts in our kids at an early age sets them up for a successful financial future. Teaching children about financial matters not only equips them with valuable life skills but also lays the foundation for their financial independence and responsibility. Let’s explore some essential key concepts in financial literacy for kids.

Delayed Gratification: A Valuable Money Lesson For Kids

Teaching kids the value of delayed gratification is crucial for smart money management. It instills the idea that saving and waiting for something can lead to greater rewards in the future. Encouraging kids to prioritize long-term financial goals over instant gratification lays a solid foundation for their financial well-being.

Instilling Values Of Financial Independence And Responsibility

Empowering kids to make sound financial decisions fosters independence and responsibility. Teaching them about budgeting, saving, and the importance of distinguishing needs from wants helps cultivate a sense of financial awareness and accountability. These values are essential for shaping responsible money habits in the future.

The Role Of Heritage Fund In Wealth Education

Introducing kids to the concept of a heritage fund can be a powerful tool for wealth education. A heritage fund can serve as a designated pool of money dedicated to future financial needs or important life events. Teaching kids about the purpose and management of a heritage fund can imbue them with a sense of financial foresight and planning.

Credit: www.biggerpockets.com

Challenges And Solutions

Teaching kids about money can pose challenges, but with the right approach, these obstacles can be overcome. From a young age, children may not grasp the concept of financial responsibility. However, interactive learning experiences and guiding them towards financial empowerment can pave the way for a brighter future.

Overcoming Common Obstacles In Teaching Kids About Money

- Engage in storytelling to explain financial concepts

- Utilize interactive activities like games to make learning fun

- Lead by example through your own responsible financial habits

Interactive Ways To Involve Kids In Managing Finances

- Set up a savings jar for them to save money

- Involve them in household budgeting discussions

- Encourage them to make their own shopping lists and compare prices

Guiding Children To Financial Empowerment And Freedom

Show children how to make wise financial decisions and the importance of saving for the future. Granting them financial freedom at a young age can instill valuable money management skills that will benefit them throughout their lives.

Impact And Future Perspectives

In today’s rapidly changing world, financial literacy has become crucial for the future success and well-being of individuals. The impact of teaching kids about money matters at an early age is undeniable. It equips them with essential skills and knowledge to navigate the complexities of personal finance and prepares them for a financially secure future.

Long-term Effects Of Early Financial Education

Early financial education sets the foundation for lifelong financial stability. Kids who learn about money management early on develop healthy financial habits that benefit them in the long run. They are more likely to make informed decisions, avoid debt, and prioritize savings. As they grow older, these children become financially responsible adults who are conscious of their spending, investments, and overall financial well-being.

Empowering The Next Generation Towards Financial Success

By empowering kids with financial literacy, we are giving them the tools they need to achieve financial success and independence. Teaching them about budgeting, saving, and investing instills a sense of responsibility and control over their financial future. It fosters a mindset of goal-setting and enables them to make wise financial choices, setting them on a path towards a prosperous and secure future.

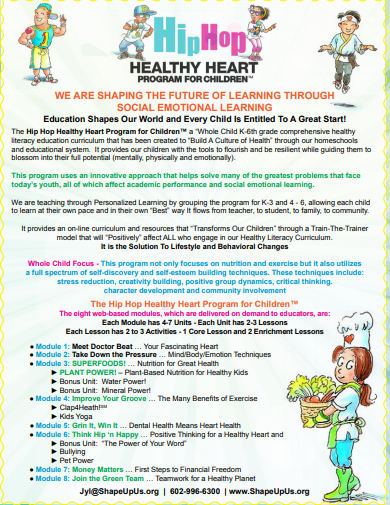

The Evolution Of Financial Literacy Programs For Kids

The importance of financial literacy for children has led to the evolution of engaging and interactive programs. Today, financial literacy programs for kids are designed to be fun, engaging, and relatable. They incorporate real-life scenarios and practical examples to make learning about money matters enjoyable and relevant. These programs provide a structured curriculum that covers various aspects of personal finance, including needs versus wants, budgeting, saving, and credit management.

| Benefits of Financial Literacy Programs for Kids |

|---|

| Develops money management skills |

| Promotes financial responsibility |

| Instills long-term savings habits |

| Prevents financial illiteracy and debt |

| Empowers kids to make informed financial decisions |

The evolution of financial literacy programs for kids ensures that children are equipped with the necessary knowledge and skills to thrive in an ever-changing financial landscape. It gives them the confidence to handle financial challenges and make informed decisions throughout their lives.

Credit: www.azhpe.org

Frequently Asked Questions For Money Matters Lessons For The Kids

How Can We Teach Children About The Importance Of Money?

Teach kids about money through interactive activities and stories on earning, saving, and financial goals. Play games like comparing prices while shopping to make learning fun and engaging.

What Does Money Matters Teach You?

Money matters teaches financial responsibility, budgeting skills, importance of saving, and value of a dollar through interactive activities and games.

What Is The 50 30 20 Rule?

The 50 30 20 rule is a budgeting guideline, allocating 50% to needs, 30% to wants, and 20% to savings and debts repayment. It helps in managing personal finances effectively.

What Do You Do In Money Matters Class?

In money matters class, you will learn about budgeting, saving, needs vs wants, making a budget, savings and checking accounts, credit vs debit, and the importance of financial responsibility. There will be interactive activities and games to help teach you these skills.

Conclusion

Teaching kids money management is crucial. Introduce real-life scenarios and interactive activities to instill a savings habit. The practical approach will help them understand the value of money without unnecessary struggles. By incorporating these lessons, you can set your kids on the path to financial responsibility.

Start early, and reap the rewards in the future.

Mother of Two children. I’m a former teacher with a background in child development and a passion for Good parenting. I understand child development and know how to develop activities to help children learn and grow. Spare time, I enjoy spending time with my family, reading, and volunteering in my community. Read More